Online Paycheck Stub Generator

Start here

Company Info.

Employee Info.

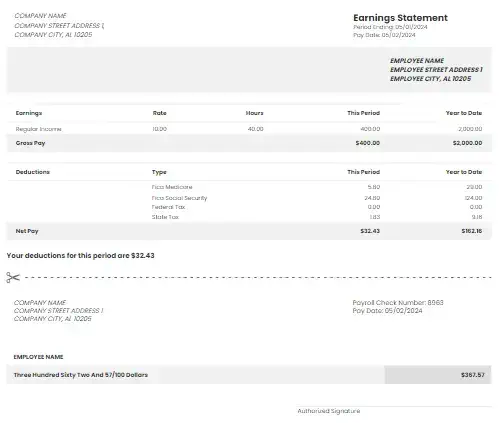

Earnings Statement

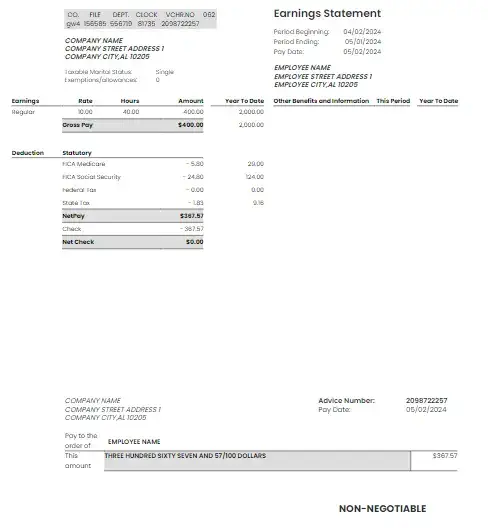

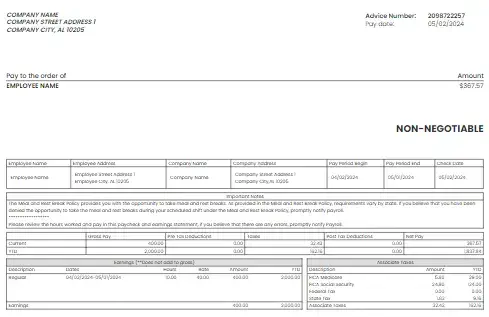

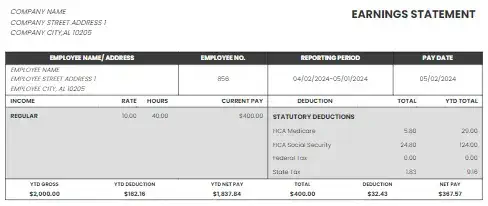

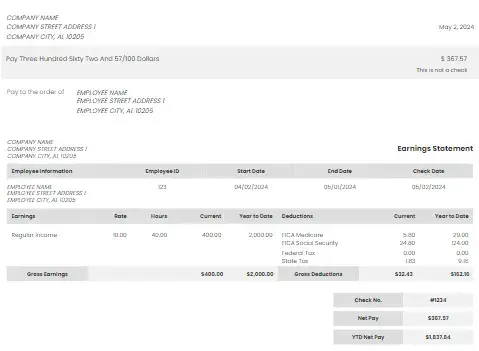

| CO. | FILE | DEPT. | CLOCK | VCHR.NO | 062 |

| Period Beginning: | |

| Period Ending: | |

| Pay Date: |

| Earnings | Rate | Hours | Amount | Year To Date |

|---|

| Gross Pay | $ | ||||

| Deduction | Statutory | ||||

| FICA Medicare | - | ||||

| FICA Social Security | - | ||||

| Federal Tax | - | ||||

| State Tax | - | ||||

| SDI | - | ||||

| SUI | - | ||||

| WC | - | ||||

| FLI | - | ||||

| Workforce Development | - | ||||

| NetPay | $ | ||||

| Check | - | ||||

| Net Check | $0.00 | ||||

| Other Benefits and Information | This Period | Year To Date | |

|---|---|---|---|

| Pay to the order of | EMPLOYEE NAME | |

| This amount | $ |

What is a Pay Stub?

A pay stub, also known as a pay recommendation, paycheck stub, or income declaration, is a document employees receive from their employers detailing how much they earned during a specific period. Typically provided alongside the wage cheque or direct deposit check stub, it serves as a comprehensive salary record. The check stub outlines deductions, along with taxes, and provides a clear picture of what stays in the end deductions are made, including the gross quantity paid. For those trying to create such files themselves, a test stub maker or pay stubs generator can help. These equipment permit users to make take a look at stubs quick and efficiently, presenting a handy manner to generate paystub or use a check stub generator to create correct earnings records and pay test maker gear.

A check stub typically includes key details such as the worker's name, the pay length, hours labored (if relevant), pay charge, and general earnings earlier than deductions. It additionally provides a breakdown of deductions for taxes, Social Security contributions, Medicare, insurance charges, retirement contributions, and another with holdings. Additionally, it could function statistics on collected vacation or ill leave, beyond regular time pay, bonuses, or different sorts of reimbursement. Using a check stub maker, you may make check stubs effortlessly and appropriately. With a pay stubs generator, you can generate paystub and manipulate payroll effectively. If you are thinking a way to make check stubs, this tool simplifies the system.

Check stubs are critical for each employees and employers. Employees depend on them to confirm a hit price and to recognize the breakdown of their income and deductions. Employers use a take a look at stub maker to hold accurate information of employee repayment, music payroll charges, and make sure compliance with tax regulations. In a few jurisdictions, employers are legally required to offer pay stubs for every pay period. Tools like a pay stubs generator make it easy to make take a look at stubs and generate paystub appropriately and correctly. Knowing the way to make check stubs is crucial for ensuring transparency. With the convenience of a paystub maker online, employers can create paystubs online and generate paycheck stub documentation speedy. Ultimately, pay stubs play a critical position in really documenting the financial transactions between employers and employees.

Why Pay Stubs Generator is Important?

-

Proof of Income: Pay stubs serve as proof of your income. Whether you're applying for a loan, renting an condo, or applying for government advantages, pay stubs validate your monetary popularity.

-

Tax Purposes: Pay stubs detail your income and deductions, assisting you accurately document your taxes. They provide crucial records together with taxable income, with holding for federal and country taxes, Social Security, and Medicare contributions.

-

Record Keeping: Pay stubs act as a record of your employment records and income. Keeping track of pay stubs allows you to display your profits, deductions, and any discrepancies which could get up.

-

Transparency: Pay stubs make sure transparency in the price technique via truly outlining how much an employee has earned and what deductions were made.

-

Legal Compliance: Many jurisdictions require employers to offer personnel with pay stubs as a part of exertions laws or regulations. Failure to accomplish that can bring about penalties or prison consequences for employers.

-

Budgeting and Financial Planning: With details on income and deductions, pay stubs help you price range successfully and plan for destiny charges. Understanding your profits and deductions permits you to manipulate your price range more efficiently.

How To Create PayStubs Online?

Here's a general guide on how to create paystubs online:

Step 1 :- Choose a Pay Stub Generator: There are many online services that provide pay stub technology. Some popular ones encompass Online Bill Generator, PaystubUSA and Check Stub Maker. Choose one which suits your wishes in terms of functions, pricing, and person interface.

Step 2 :- Sign Up or Log In: Once you've got decided on a pay stub generator, join up for an account or log in in case you already have one or use as a visitor consumer.

Step 3 :- Enter Company and Employee Information: Provide your employer's call, deal with, and other applicable information. Then, enter the worker's information which includes call, deal with, Social Security variety, and employment repute.

Step 4 :- Enter Payment Details: Input the charge duration (e.G., weekly, bi-weekly, month-to-month), pay price, hours worked, time beyond regulation hours (if applicable), and any deductions or with holdings.

Step 5 :- Review and Verify: Double-check all the information you've got entered to ensure accuracy. Mistakes in Online paystub can cause confusion and frustration along with your employees.

Step 6 :- Pay Service Charge: Most online paystub generator require a charge for their services, both via subscription plans, pay-consistent with-use models, or one-time prices.

Step 7 :- Generate the Pay Stub: Once your payment is complete, you can instantly download your check stubs. The online pay stubs generator creates a convenient PDF file that you can easily save and access whenever needed. This service allows you to efficiently generate paystub records, making it an ideal solution for managing your payroll needs with ease and accuracy.

Step 8 :- Distribute to Employees: After producing the online pay stub, distribute it to your employees electronically or in print, depending on your corporation's policies and the options of your employees.

Who Needs an Online Paystub?

A pay stub serves various purposes for different individuals and entities:

-

Employees: Check stubs are essential for employees as they provide a clear breakdown of their earnings for a specific pay period. These documents include details such as gross wages, tax deductions, benefits, and the net amount received. Using a pay stubs generator, you can efficiently generate paystub records, including a Direct Deposit Check Stub, which helps employees track their income, understand their tax obligations, and ensure accurate payment.

-

Employers: Pay stubs function a report of fee for employers. They file the wages paid to every employee, at the side of any deductions made. Pay stubs moreover provide transparency and duty, as employees can talk with them if there are any discrepancies or questions about their repayment.

-

Government Agencies: Pay stubs are frequently required by government agencies for various purposes. For example, when applying for loans or financial assistance, individuals may need to provide pay stubs as proof of income. Similarly, tax authorities may request pay stubs during audits to verify income and deductions reported on tax returns. Using a pay stubs generator, you can easily generate paystub records with an online paystub generator. This enables you to create paystubs online, including the option to generate a Direct Deposit Check Stub, ensuring your financial documentation is complete and accurate.

-

Financial Institutions: When the use of for mortgages, automobile loans, or credit score score, financial establishments also can moreover request pay stubs to assess an character's economic stability and capacity to repay the mortgage.

-

Legal Proceedings: Paystubs may be used as evidence in legal court instances, which encompass disputes over wages or employment contracts. They offer a clear file of the phrases of employment and the compensation provided, that could help solve disputes or guide claims in court.

Components of a Online Pay Stub:

-

Employee Information: This section generally includes the employee's call, deal with, Social Security variety, marital repute, cellphone number and on, occasion their employee identity wide variety.

-

Employer Information: This section commonly includes the employer's call, cope with, logo, telephone quantity and federal organization identification wide variety (FEIN).

-

Pay Period: The dates covered via the pay stub, normally per week, bi-weekly, or monthly.

-

Earnings: Details of the employee's profits for the pay period, consisting of

-

Gross Pay: Total income earlier than deductions

-

Regular Hours: Number of regular hours worked.

-

Overtime Hours: Number of time beyond regulation hours labored (if applicable).

-

Overtime Pay: Additional pay for time beyond regulation hours worked (if relevant).

-

Bonus:Any extra profits inclusive of bonuses or commissions.

-

Reimbursements:Any reimbursements for paintings-associated prices

-

-

Deductions: Amounts deducted from the worker's gross pay, which includes:

-

Taxes: Federal, nation, and nearby profit taxes.

-

Social Security Tax: Deduction for Social Security contributions.

-

Medicare Tax: Deduction for Medicare contributions.

-

Health Insurance: premiums for health insurance.

-

Retirement Contributions: Contributions to retirement bills (e.G., 401(k)).

-

Other Deductions: Any different deductions together with for union dues or garnishments.

-

-

Gross Pay: This phase details the worker's gross pay, that's the entire quantity earned earlier than any deductions are made. It may additionally consist of beyond regular time pay, bonuses, commissions, or other varieties of additional reimbursement.

-

Net Pay: The amount of money the employee in reality gets in spite of everything deductions have been subtracted from gross pay.

-

Year-to-Date (YTD) Totals: Cumulative totals of income and deductions from the start of the calendar 12 months to the contemporary pay period.

-

Employer Contributions: Any contributions made by the agency on behalf of the employee, along with contributions to retirement plans or fitness financial savings accounts.

-

Additional Information: This section may include statistics about paid break day (e.G., vacation or sick leave), compensation for fees, or every other relevant information precise to the pay duration.

Who Can Benefit from Paystub generator?

-

Small Business Owners: Streamline your payroll device and ensure accuracy with out the want for highly-priced accounting software software.

-

Freelancers and Contractors: Create expert paystubs to provide evidence of profits for condominium applications, mortgage approvals, and extra.

-

HR Professionals: Simplify the payroll way for your organization and decrease the risk of compliance errors.

-

Individuals: Whether you are utilizing for a loan or renting a cutting-edge apartment, having accurate paystubs may want to make all of the distinction.

How to Read a PayStub?

-

Start by way of reviewing the employee facts phase to make sure all private details are correct and updated.

-

Check the earnings section to verify the gross pay and any extra repayment such as bonuses or time beyond regulation.

-

Review the tax with holdings to ensure the right quantities are being withheld for federal, country, Social Security, and Medicare taxes.

-

Examine the deductions segment to recognize where your money is going. Make sure to affirm the quantities deducted for blessings and every other voluntary deductions.

-

Calculate the internet pay via subtracting the overall taxes and deductions from the gross pay. Ensure that the internet pay suits the quantity deposited into your financial institution account or furnished at the paycheck.

-

Finally, compare the year-to-date totals with your personal statistics to tune your profits, taxes, and deductions over the years.

What common errors occur when making pay stubs?

When creating pay stubs, some common mistakes to avoid include:

-

Incorrect Information: Ensure that all information which include worker call, pay length, hourly charge, hours worked, deductions, and internet pay are accurate. Mistakes right here can cause confusion and capacity disputes.

-

Omitting Deductions: It's essential to include all applicable deductions inclusive of taxes, coverage rates, retirement contributions, and some other with holdings. Failure to achieve this can result in discrepancies between the pay stub and the real quantity obtained by using the worker.

-

Not Including Overtime or Bonuses: If relevant, ensure to appropriately calculate and encompass extra time pay or bonuses earned by means of the employee all through the pay period. Omitting those can result in underpayment and dissatisfaction among personnel.

-

Ignoring State and Federal Regulations: Different states and nations have specific laws and rules regarding pay stub necessities. Ensure that your pay stubs observe all relevant rules to keep away from legal issues or penalties.

-

Forgetting to Include Pay Period Dates: Clearly indicate the start and end dates of the pay length at the Online pay stub. This facilitates employees to understand which dates the payment covers and prevents confusion

-

Failing to Keep Records: Keep accurate facts of all pay stubs issued to personnel for future reference and auditing purposes. Failing to maintain proper information can result in compliance issues and difficulties in resolving disputes.

-

Not Double-Checking for Errors: Always double-check the pay stubs for any errors or inconsistencies earlier than issuing them to employees. This extra step can assist capture mistakes and make sure that employees are paid successfully and on time.

Is it Acceptable to Use Online Paystub as Proof of Income?

Yes, paystubs are generally popular as proof of income. They provide info which includes the quantity earned, deductions, and once in a while yr-to-date profits, which could exhibit your earning potential to creditors, landlords, or other entities requiring evidence of profits.

It's important to note that the acceptability of pay stubs as proof of income can vary depending on the entity requesting the documentation. Some may have specific requirements regarding the format or frequency of pay stubs, while others may accept digital versions or printed copies. In certain cases, people may want to provide additional documentation or causes to assist their take a look at stubs, specially if there are irregularities or fluctuations in earnings. Using a pay stubs generator, you may effortlessly generate paystub records thru a Online paystub generator. This allows you to create paystubs online, consisting of a Direct Deposit Check Stub or different check stub formats. If you are uncertain the way to make check stubs, a check stub maker can simplify the system for you.

Overall, paystubs are a typically used and effective device for demonstrating income and financial balance in numerous contexts, making them a treasured asset for people navigating monetary transactions or duties.

Why Use PaystubUSA for Generat Paystub?

Effortless Interface Facilitating Rapid Generation: Our platform offers a consumer-friendly interface designed to streamline the manner of generating paystubs quick and correctly.

Precise Calculations Ensuring Tax Compliance: We prioritize accuracy in all calculations to make sure compliance with tax pointers, imparting peace of thoughts to our customers.

Wide Array of Customization Options: Tailor your paystubs for your exact specifications with our variety of customization features, allowing you to customize them in line with your precise dreams.

Automated Paystub Generation for Time Savings: Say goodbye to guide techniques. Our machine automates the technology of paystubs, saving you valuable time that can be better utilized elsewhere.

Access Paystub Creation Anytime, Anywhere, on Any Device: Whether you're inside the place of job, at domestic, or on the bypass, you could create paystubs seamlessly from any device with internet get right of entry to, providing top notch consolation.

Commitment to Data Security and Privacy: We recognize the significance of safeguarding your touchy facts. That's why we prioritize the safety and privacy of your data at each step.

Dedicated Customer Support for Prompt Assistance: Our dedicated customer support team at any time because they are always available for your assistance purposes and queries in order to make the process of buying things go as smoothly as possible.

Support for Multiple Payment Methods: We accommodate numerous payment techniques to cater on your alternatives, supplying flexibility and convenience in dealing with your budget.

Continuous Updates and Enhancements Based on User Feedback: We cost your input. Regular updates and upgrades are implemented based totally on consumer comments, making sure that our platform evolves to satisfy your evolving wishes.

Satisfaction Guarantee with Timely Issue Resolution: Your pride is our priority. We stand behind our carrier with a satisfaction assure and directly deal with any issues which can arise, making sure a tremendous revel in for all our users.

Can I Make a Paystub for California?

Yes, you can easily create a paystub for California using our paystub generator. In fact, many of our customers come from states like California, Texas, Florida, New York, and Illinois. While these are some of the most popular states we serve, our service is not limited to them. You can generate professional paystubs for any state in the United States.

Additionally, customers from anywhere in the world can use our service to create paystubs with accurate U.S. tax calculations, making it a convenient solution no matter where you are located.

Can I Make a Paystub if I am Self-Employed?

Absolutely. Our paystub generator is widely used by self-employed individuals, freelancers, and small business owners who need professional paystubs without the hassle of expensive payroll software.

Self-employed professionals often create paystubs to use as proof of income for loans, rentals, or personal records. However, our service is open to anyone who needs a paystub, whether for employment, contract work, or business purposes.

PaystubUSA vs AI Paystub Generators?

When comparing different paystub services, accuracy and reliability are key. Some online paystub makers may not always provide consistent results or may lack up-to-date tax bracket calculations, leading to errors.

With PaystubUSA, you can be confident that your paystubs are generated with 100% accurate tax calculations and consistent formatting. Our service ensures that your paystub meets professional standards, giving you peace of mind whenever you need to present it as proof of income.