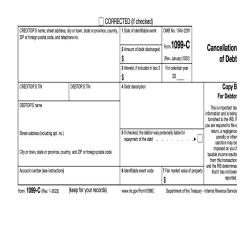

1099-C Form

What Is a 1099-C Form? Use an Online Generator for Easy Filing

Form generation can be made easy by using an online 1099-C form generator. Ever had someone whose debt you cancelled or forgave? Everyone who owed you money has probably done this to you. The form is a report of cancelled debt to the IRS. A lender is required by law to issue to you and the IRS a form if they cancel or forgive more than $600 in debt. Let's take a glance at what the 1099-C form is, when you need it, and how you can easily file it using an online generator in this blog.

What Is This Form?

This tax form is the Cancellation of Debt. Also, you can easily generate it by using an online 1099-C form generator. To put it in simple terms, they're the forms a financial institution would send to you and the IRS when they're going to cancel debt owed by you. This form will report the cancelled amount, and you may have to add that to your return. So, you would keep a record of it because cancelled debt impacts your taxable income, which forms the tax one is supposed to pay. That can be an important form, from a tax perspective, so understanding what the form is does mark an important necessity when it comes to managing personal finance.

When To Use This Form?

You will receive this form generated using the 1099 c generator if a creditor forgives or cancels a debt of $600 or more. This might be in several circumstances, for instance, if you are negotiating to pay off the debt with your creditor, you are going through foreclosure on your property, or part of a student loan has been discharged. Once you get that form created with the maker, make sure you read it carefully. All details stated by the lender to you, including name and address and the amount of debt cancelled, must be correct.

How to File Your Form Easily

Though this may be a bit hassle, you can take very simple steps to file your form. The most effective way to get the process done is through an online paystub generator. These generators guide you on every detail making it easier for you to fill out the form. All the necessary information on yourself and the amount of the cancelled debt must be entered. From this information, the generator will fill out the form for you. Filling it out using an online generator makes the process less time-consuming and hassle-free so that you may focus on other important matters. Knowing when and why you will get a form will always prepare you for tax season.

In A Word

You can make filling it out as simple as possible by using a PAYSTUBUSA online 1099-C form generator. You should be clear about this form if you've had any debt cancelled or forgiven. Follow these steps, and filling out your form will not be a problem for you. You will be financially organized, and not the stress of tax season will get you going. And learning about the tax form will make the whole procedure very smooth!