Paystub

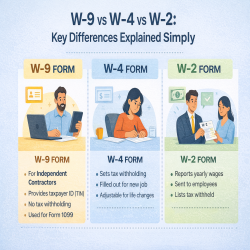

W-9 vs W-4 vs W-2: Key Differences Explained Simply

Tax forms like W-9, W-4, and W-2 can be confusing, especially when this might be a part of something you have never dealt with before. Most people have no idea what form they need, what each form is for, or how those forms are going to affect their taxes. This is a very common misunderstanding for employees, freelancers, and even business owners.

In this detailed article, we will compare and contrast W-9 vs W-4 vs W-2, explain the purpose of each form, the person who needs it, and the time it is necessary. Ultimately, you will master these three forms and discover how a W-2 online generator tool can help you with your tax work.

Why Should These Tax Forms Matter to You?

The IRS utilizes these tax forms to monitor income and tax payments and hence make sure that the following is done properly:

- income is reported accurately

- taxes are withheld correctly

- employer and employees adhere to the IRS rules

If you use the wrong form or fill it out improperly, you will be subjected to fines, will have your refund delayed, or your incorrect tax return may cause troubles.

What Is a W-9 Form? (Independent Contractors)

A W-9 form is a document used to give your tax information to someone who pays you but doesn't classify you as their employee.

Who should complete a W-9?

- Freelancers

- Independent contractors

- Consultants

- Gig workers

- Vendors and service providers

What kind of data does a W-9 ask for?

- Legal name

- Business name (if any)

- Address

- Social Security Number (SSN) or Employer Identification Number (EIN)

What's the purpose of W-9?

You sign a W-9 and send it to the payer so they have your right details when they report your income to the IRS, typically through a 1099-NEC form.

Taxes are not withheld when you submit a W-9. Hence, you need to take care of your tax payments on your own.

What Is a W-4 Form? (Employees)

A W-4 is a tax form completed by a new employee to set the correct amount of tax to be withheld from their paychecks.

Who is supposed to complete a W-4?

Employees, whether they work full-time, part-time, or only during a particular season

What does a W-4 affect?

- Federally mandated tax withholding

- Dependents or other income adjustments

A properly completed W-4 form is the best way to avoid:

- Finding out that you owe a big tax bill

- Paying too much tax and having to wait for the refund

If your financial situation changes, you can always submit a new W-4.

What Is a W-2 Form? (Annual Wage Statement)

An employer gives the employee a W-2 form after finishing the year. This is a record of the employee's pay and taxes withheld.

Who receives a W-2?

- Anyone paid as an employee

- Employees whose salary has been processed by payroll

What does the W-2 report contain?

- Total paid wages

- Federal income tax withheld

- Other taxes such as state and local (if any)

- Social Security and Medicare tax amounts

- Information about the employer

Employees need their W-2 to prepare their tax returns.

Mistakes Commonly Made by Taxpayers

Many tax headaches result from errors such as the following one:

- Contractors mistakenly fill in a W-4 instead of a W-9

- Employees wrongly expect to get a 1099

- Incorrect form being issued by a business

- Deadline for W-2 was missed

Knowing the difference among W-9 vs W-4 vs-W-2 is one step to managing your taxes properly and efficiently.

Why Employers Need Accurate W-2 Forms

Employers must by law provide employees with W-2 forms no later than January 31. Failure to submit W-2 forms or submitting them with errors can lead to the following:

- IRS fines

- Worker grievances

- Delayed tax returns

This is one of the reasons many companies opt for a W-2 generator to prepare their W-2s rather than doing everything by hand.

How an Online W-2 Generator Helps

Preparing W-2s by hand is both laborious and error-laden. An online W-2 generator might even make the task a breeze.

Using a reputable W-2 form generator, you will be able to:

- Have your W-2 forms ready within a few minutes

- Keep errors in calculating to a minimum

- Print download

- At the same time, have the employee securely shared

A professional W-2 creator is adequate for small businesses, startups, and payroll managers.

Generate W-2 Forms Easily with PaystubUSA

PaystubUSA is a reliable online partner where you can find a secure, straightforward W-2 generator tool for free that takes the worry out of compliance.

Using PaystubUSA has the following advantages:

- Quick and correct W-2 creation

- Easy-to-use interface

- Document security

- Great for both business and personal use

If you are interested in generating W-2 forms or organizing payroll records, PaystubUSA is the answer.

Which Form Do You Need?

A simple way to decide:

Do you work as a freelancer or contractor? → W-9

Are you an employee who is about to start working? → W-4

Are you an employee filing taxes? → W-2

You can save a lot of time and avoid tax confusion if you know this simple rule.

Final Thoughts

The difference in distinction of W-9, W-4, and W-2 is pretty useful to contractors, employees, and employers in general. In the case of a freelancer or an independent contractor, the W-9 is used when one needs to share their tax information. A W-4 is used by an employee to help the employer with the right amount of tax withholding, while a W-2 is used for a summary of wages and tax withholdings for the year. Proper use of a correct form can save you from tax mistakes, waiting for tax refunds, and unfair penalties.

One of the advantages of having the right set of tools is that it makes the work of handling your income or your business payroll smoother. When it comes to tax documentation, PaystubUSA is the answer to the problem as a service that offers accurate and dependable solutions to create and manage pay stubs and tax forms, thus facilitating your organization, compliance, and assurance during the tax season.