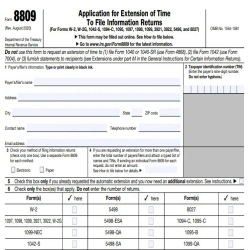

8809 Form

Top Benefits of Using the Online 8809 Form for Tax Filing Extensions

Tax time limits may be overwhelming for corporations and individuals alike. Missing the closing dates can result in penalties, fines, and pointless pressure. Fortunately, the IRS affords a solution for individuals who need extra time to document their tax returns: the 8809 form. By submitting an Online 8809 Form, you could request an extension on your tax submitting cut-off date with minimal hassle. In this weblog, we’ll explore the top blessings of the use of the web model of the 8809 form, along with how it simplifies the process and ensures you meet IRS requirements without complications.

Convenience and Accessibility

One of the most widespread benefits of the use of the Online 8809 Form is its accessibility. You no longer need to download, print, and mail paper forms. Everything is finished electronically, saving you time and effort. Since the form is available online 24/7, you can put up your extension request from anywhere, at any time. Whether you're visiting for business or dealing with tax arrangements at the closing minute, the online form ensures that you can meet the IRS deadline without having to be in a particular vicinity.

Faster Processing Time

Compared to mailing a paper form, filing an Online 8809 Form substantially reduces the time it takes for your extension request to be processed. The IRS receives the request straight away after submission, meaning you get faster affirmation. Since the web gadget is without delay related to IRS databases, it removes any delays that may occur with physical mail delivery.

Faster processing ensures you’re notified right away approximately the fame of your extension, giving you peace of thoughts. This pace can be important in case you're approaching the tax deadline and want to recognise if the extension became normal earlier than making plans for the subsequent steps for your tax submitting method.

Reduced Errors and Rejections

The online platform for the 8809 form includes built-in assessments and validations that decrease mistakes at some stage in the submission manner. For instance, in case you forget to fill out a required subject or input incorrect statistics, the system will alert you to the mistake earlier than you put up the form. This characteristic extensively reduces the probability of your extension request being rejected due to incomplete or incorrect information.

Tracking and Confirmation

When you submit a paper form via mail, monitoring its progress may be challenging, and there’s always the opportunity of it getting lost. With the Online 8809 Form, you receive immediate confirmation of receipt from the IRS. You also can track the status of your request via the online portal, so you always recognise in which your extension stands.

This transparency gets rid of the guesswork related to conventional mail and affords real-time updates on your extension request. You’ll have a digital record of your submission, that is without difficulty accessible for destiny reference or if any questions arise regarding your tax filing timeline.

Cost-Effectiveness

Submitting the Online 8809 Form is often more cost-effective than submitting it through mail. You store printing expenses, postage charges, and every other charge associated with mailing a paper form. Additionally, many 8809 Form Generator equipment are to be had online, offering inexpensive answers for individuals and companies looking to automate and streamline the submitting technique.

Eco-Friendly Solution

Reducing paper utilization is a significant step toward environmental responsibility in a generation where sustainability is more essential than ever. Filing your 8809 Form online allows reduce your carbon footprint by removing the need for paper bureaucracy, envelopes, and physical mail shipping. It’s a small but impact manner to contribute to a greener, extra eco-friendly commercial enterprise practice.

This advantage is particularly relevant for corporations and individuals who submit multiple extension requests for the year. By transitioning to online submissions, you’re now not only simplifying your tax process but also doing your component to limit environmental waste.

Enhanced Security

Handling touchy tax records calls for maximum security, and the Online 8809 Form machine is ready with strong measures to guard your information. The IRS online portal makes use of encryption and different protection protocols to ensure that your statistics are transmitted correctly. In evaluation, mailing physical paperwork increases the risk of loss, theft, or damage for the duration of transit.

By the usage of an 8809 Form Generator and submitting your extension online, you benefit from a layer of protection for your personal and enterprise records. This greater safety can offer peace of mind, in particular when handling critical tax cut-off dates and touchy financial information.

Conclusion

The Online 8809 Form offers an extensive range of benefits, from comfort and faster processing to more suitable security and fee effectiveness. By casting off the hassles of paper submissions and providing actual-time tracking and affirmation, the net gadget guarantees a clean and green extension manner. Whether you're a person filer or a business coping with more than one tax filing, the usage of an 8809 Form Generator can assist in streamlining the system and reduce the hazard of errors.

If you're searching out greater equipment to streamline your commercial enterprise operations, from payroll management to test stub era, PaystubUSA gives several services designed that will help you stay prepared and compliant quite simply. Consider PaystubUSA for all of your virtual commercial enterprise desires! You can read more information on Generate Pay Stubs Online.