Federal Tax Calculator

Federal Tax Comparison for 2024 and 2025: Understanding Tax Rates

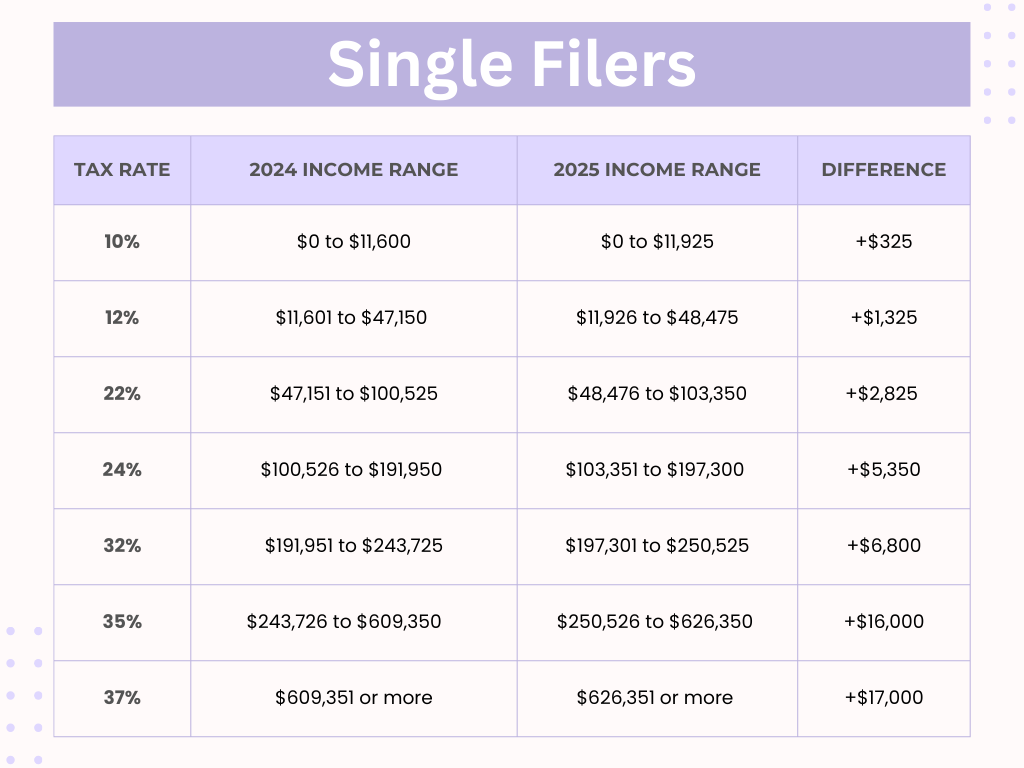

The tax brackets are indexed for inflation every year, so that is important to know for tax planning purposes. This report compares the 2024 and 2025 brackets for federal taxation across the four core filing statuses Single, Married Filing Jointly, Married Filing Separately, and Head of Household.

Comparison of Federal Taxes: 2024 to 2025

Overview of Changes

While tax rates are unchanged from 2024 to 2025, the income limits for each of the brackets have been increased at the rate of inflation. The new and revised brackets have a similar function of circumventing “bracket creep,” an inflationary phenomenon in which instinctive increases in personal income push individuals into a higher tax bracket, even if purchasing power has not increased.

Key Observations

Inflation Adjustments: All income levels in all tax brackets and all filing statuses will be adjusted for inflation in tax year 2025. These increases help minimize the odds taxpayers will be forced to pay a higher tax rate just because of inflation-induced increases in their income. Use a Federal Income Tax Calculator to understand how these adjustments may affect your tax situation.

Top Marginal Rates: In the tax year 2025, the 37% rate only applies to income above $626,351 (Single, Head of Household) or $751,601 (Married Filing Jointly) These exceed the 2024 thresholds of $609,351 and $731,201. This change primarily impacts higher-income taxpayers.

Lowest Brackets Get a Small Boost: The income ceilings for the lowest brackets, like the 10% and 12% brackets, also saw moderate increases. Single filers in the 10% bracket now can earn an extra $325 in 2025 before they enter the 12% bracket, for example.

Filing Status Perks: Married people filing jointly are still pretty much the bomb, as their qualifying income thresholds for each step up are almost double that for Single filers. For couples who combine their incomes on 1 return, that could result in significant tax savings.

Conclusion

The 2025 federal tax brackets reflect inflation adjustments, benefiting taxpayers of all incomes and filing statuses. The changes will lighten the tax burden as they will retain taxpayers in their current brackets despite inflation-driven increases in income.

For individuals and households, the updates allow for revisiting how much has been withheld adjusting estimated tax payments and factoring in potential deductions and credits. To help you make the most of these changes, speak to a tax consultant about your specific tax planning needs.

At PaystubUSA, we’re here to support your financial planning needs with tools like our payroll and Paystub Generator, ensuring accuracy and ease in managing your finances.